Uganda is rapidly emerging as a key player in the fintech and financial services sector within Africa, buoyed by innovations in mobile money and digital banking. With Kampala as its capital and financial hub, the country is working through various economic challenges, including health crises as well as strict lockdowns.

Despite these hurdles, Uganda’s commitment to financial inclusion is evident in its robust mobile money ecosystem, diverse fintech solutions in savings, lending and remittances, and progressive regulatory frameworks aimed at fostering growth and innovation.

Capital and financial hub

Kampala

Key economic development strategy

Uganda Vision 2030

Economic, financial services and fintech overview

In recent years, Uganda has faced various challenges, from Ebola outbreaks to stringent Covid-19 lockdowns. Despite these difficulties, the country has witnessed significant growth in its financial services and fintech sectors, driven by both organic market dynamics as well as government support.

In the payments space, mobile money has emerged as the dominant ecosystem in Uganda, with a range of players including aggregators, telecoms, and banks offering mobile wallet solutions. These platforms facilitate a wide array of transactions, including utility payments, bank-to-consumer transfers, e-commerce transactions, and retail payments. Additionally, the country has seen the emergence of numerous mobile and digital wallet providers, further diversifying the payment landscape.

Fintechs in Uganda have also made significant strides in savings and lending, catering to niche markets such as asset lending, solar energy, agro-business, micro-loans, and savings. Leveraging their understanding of traditional Ugandan SACCOs and microfinance structures, these fintechs offer digital transformation solutions to enhance financial inclusion.

The e-commerce sector in Uganda has also experienced notable growth, particularly during the pandemic, with platforms like Safeboda, Jumia, and Glovo expanding their presence. However, disparities in internet access remain, with higher smartphone usage observed in urban centres like Kampala compared to rural areas.

Remittances

In the realm of remittances, mobile money platforms like Airtel Money, MTN Mobile Money, and Eversend have played a crucial role in facilitating transactions for the unbanked population. These platforms have enhanced connectivity between financial institutions, businesses, and consumers through mobile and digital wallets, catering to the significant number of Ugandans working abroad who send money back home.

Regulatory frameworks in Uganda have evolved to accommodate the shifting landscape, with a greater emphasis on mobile money and open-ended financial regulations. This regulatory flexibility has supported innovation and growth in the fintech sector.

In addition to the mentioned fintechs, Uganda is home to other notable players such as Pivot Payments (a neobank), Dusupay (specialising in money remittances), and Tugende (offering asset finance solutions).

Key organisations:

■ Bank of Uganda (BoU) – Country’s central bank

■ Uganda Investment Authority – The country’s investment promotional agency

■ Financial Technology Service Providers’ Association (FITSPA) – The umbrella body for fintechs in Uganda

■ Financial Sector Deepening Uganda (FSDU) – Independent non-profit focusing on leveraging digital finance in Uganda

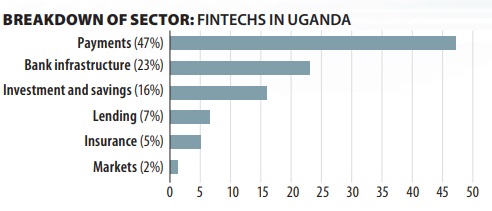

Sector breakdown

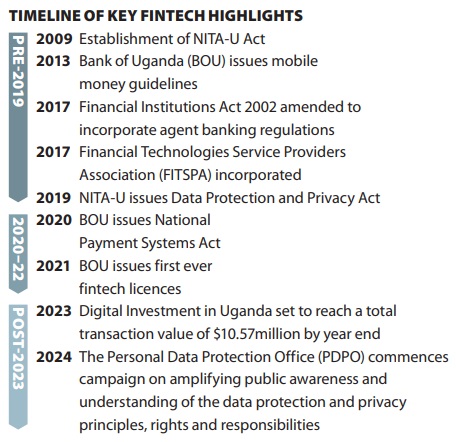

Timeline of key fintech highlights:

Uganda has the following key fintech milestones:

- 2009 Establishment of NITA-U Act

- 2013 Bank of Uganda (BOU) issues mobile money guidelines

- 2017 Financial Institutions Act 2002 amended to incorporate agent banking regulations

- 2017 Financial Technologies Service Providers Association (FITSPA) incorporated

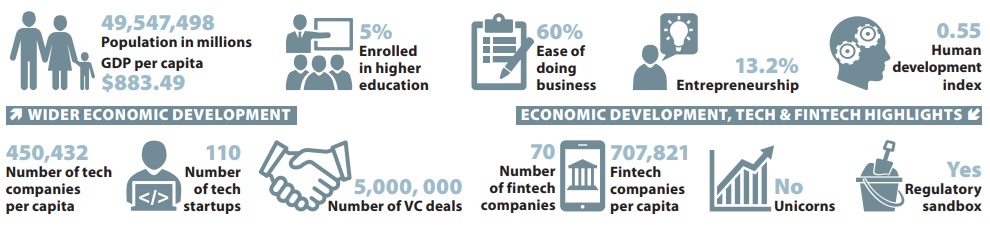

Key statistics of the country: